From toilet paper to industrial chemicals, there’s no doubt the COVID-19 pandemic has been disruptive to global supply chains.

But how important are large, multinational companies in maintaining both local and international logistic networks and should governments be so focused on maintaining larger organisations through subsidies and bail-outs over their smaller counterparts?

A new network analysis by researchers from the University of Sydney’s School of Project Management and the Centre for Complex Systems within the School of Civil Engineering has found that large, multi-national organisations are not always as crucial to local supply chains, and that it’s sometimes the smaller operators that can deliver the hardest logistic shocks to a community when disrupted.

“In the current context where a pandemic is spreading in the world, industry output has already been severely impacted and supply chains have been disrupted. The full effect of this will only become apparent in coming months and years, but it’s clear that COVID-19 has already caused ‘kinks’ in the movement of goods and services around the globe,” said lead author Dr. Mahendra Piraveenan from the Faculty of Engineering.

“Our study has sought to understand whether types of businesses play more central or local roles, and how shocks might cascade along the chain of firms.

“Governments often provide bail-out packages to large organisations in a bid to save jobs. However, organisations which are central to supply chains should also be supported, even if they are relatively small, because they may be more important to a country’s economy.

“For example, there is no point bailing out a car manufacturer if many of the companies that supply the necessary parts go bankrupt – that will mean the car manufacturer cannot get back on its feet regardless.”

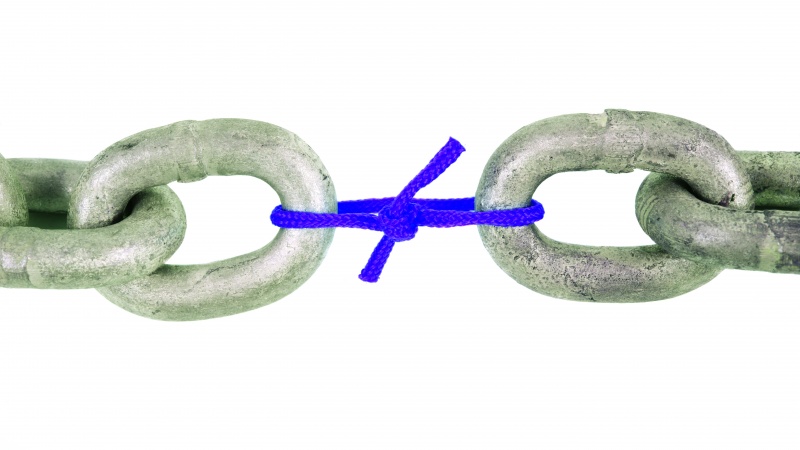

School of Project Management academic, Dr. Petr Matous said that when the operations of some organisations are disrupted by social distancing policies, they may send shocks “downstream” to their clients who cannot access their components, which in turn triggers disruptions to the clients of clients.

“However, how much a failure of one firm affects economies around the world depends on multiple factors, it’s not so simple that a disruption of a larger firm would always cause more losses. The structure of the international supply networks plays a role in this,” said Dr. Matous.

Organisations deliver supply chain shocks like COVID-19 super-spreaders

“Similarly to COVID-19 “super-spreaders”, organisations that can facilitate the spread of supply chain shocks are not always the biggest ones nor necessarily the ones with the most supply chain connections,” said Dr. Matous.

“We identified when supply chain clusters overlap with country boundaries but often they don’t and in such cases and industries, fast international contagion of shocks is possible,” he said.

The researchers also found that organisations that originate from a certain country, but register themselves elsewhere, are often less central to the supply chain network of the country in which they are registered, yet are more central in the global supply chain network due to their international roots.

For example, a Chinese packaging group that was registered in the United States was found not to be important to their supply chains but was important on a global scale.

Strength in numbers

The study found that structural clustering – known as community structures – of global supply chains are strongly influenced by the industries that organisations belong to.

“We identified industry sectors and countries which tend to form strong communities in terms of supply chains, and are therefore are less vulnerable to fluctuations in the global supply chain network, such as finance, insurance, real estate, transportation, construction, manufacturing,” said Dr. Piraveenan.

HOW THE RESEARCH WORKED

Working alongside Professor Yasuyuki Todo from Waseda University, the researchers created a supply chain network that analysed 154, 862 organisations of ten countries, which were selected due to high representation in the dataset and regional economic importance. These countries including the United States, Russia, China, India, United Kingdom, France, Canada, Australia, Japan and Singapore.