Over the next 25 years, as the world shifts away from fossil fuels, the oil and gas wells that have sustained the fossil fuel age will have to be plugged.

No big deal, you might think, drilling those wells was the hard part. Plugging them should be no problem. But think again.

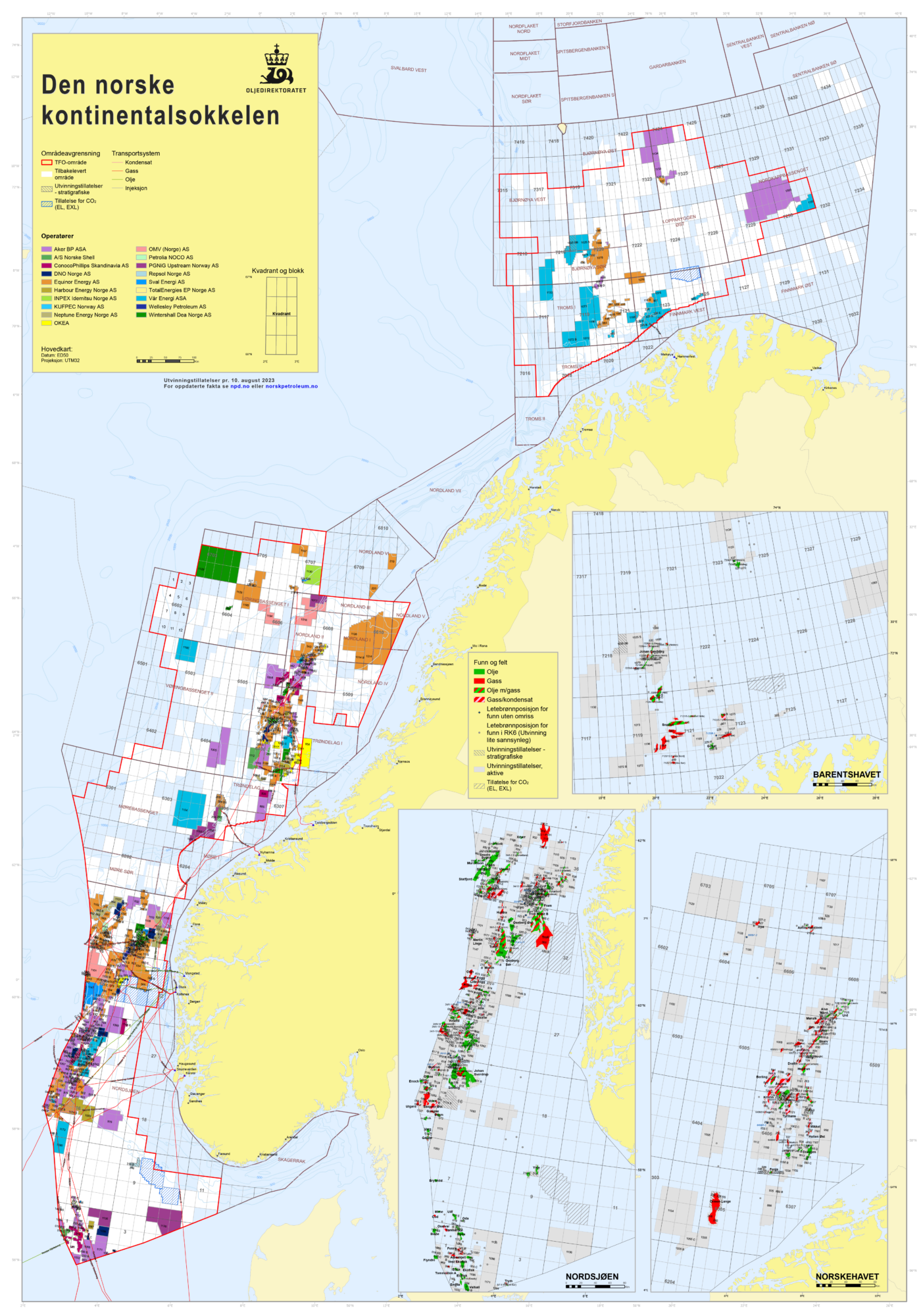

The Norwegian Continental Shelf, as an example, is punctured by more than 2000 wells. Harald Linga, centre director for SWIPA (see box), a Centre for Research Based Innovation based at SINTEF, Scandinavia’s largest independent research institute, estimates that plugging them using today’s technology will cost upwards of NOK 800 billion – that’s USD 73 billion.

And while oil companies are responsible for plugging the wells, Norwegian taxpayers will have to shoulder 78 per cent of these costs.

And that’s just Norway. The total number of oil wells across the globe could number in the millions, all of which at some time will have to be plugged.

A search for alternatives

Today’s technology involves using a cement plug that can be between 50-100 metres long. These plugs, it turns out, aren’t that great. They can develop leaks over the long run, for many different reasons, says Lewaa Hmadeh, a PhD candidate at the Norwegian University of Science and Technology (NTNU’s) Department of Geoscience and Petroleum who is also affiliated with SWIPA. One of the most troubling problems is that leaking abandoned petroleum wells can be a significant source of greenhouse gas emissions, he said.

“Every year, the Norwegian Oil and Gas Association sets a roadmap for new plugging and abandonment technologies needed to solve problems faced by the industry, and ever since 2015, finding an alternative to cement has always been there,” Hmadeh said.

But there’s hope in sight.

Hmadeh’s PhD research involves studying the use of bismuth as a substitute and/or additive for plugging wells. He’s one of many scientists across the globe trying to find a better solution for this challenge. And if his initial results are any indication, a mix of bismuth and tin could offer the petroleum industry a safer and cheaper solution to well plugging than cement.

The problem

First of all, it’s important to remember that plugging an oil well is an expense that is just that – by definition, it’s done at the end of the life of the well, so it is a cost for which there is no income.

“There’s no revenue,” Hmadeh said. “You are literally burying the money there in the ground.”

Cement has become the industry standard, in part because the substance itself is relatively cheap, and its properties are well known. But over time, the problems with a cement plug – which under Norwegian regulations, needs to be between 50-100 metres long – have come clear, Hmadeh said.

“They are highly vulnerable to corrosion,” and to CO2, or hydrogen sulphide, both of which are found in subsea well environments, he said. The plugs also have to withstand huge differences in pressure above the plug and below.

They can crack or lose their seal in the high pressure, high temperature environments that are typical of wells. And perhaps most importantly, cement also shrinks as it cures, which causes the formation of little pores.

“These can be paths for hydrocarbons to migrate to the surface,” Hmadeh said.

The industry has experimented with different alternatives, varying from adding substances to cement and testing other substances, including bismuth. That’s where Hmadeh’s work comes in.

Why bismuth?

Bismuth alloys are impermeable, which means there is no chance for there to be leaks through the plug, Hmadeh says.

And unlike cement, which shrinks as it solidifies, bismuth alloys expand as they solidify.

“They also maintain their integrity over the long term, because they are not affected by corrosion, or by CO2 or hydrogen sulphide. And they also have a reduced installation time due to the rapid hardening of the alloy,” Hmadeh said.

This last can be an important factor on the Norwegian Continental Shelf, where sea conditions can be challenging, and the less time needed to install the plug, the better, he said.

“Reduced installation time reduces the rig time, which in turn reduces costs,” Hmadeh said. “One other aspect of bismuth alloy plugs is that they have the potential to be deployed riglessly, meaning that without the neccessity of having a rig in place. This will in turn cut on costs drastically, as most of the costs offshore come from the ‘rig-rental’ costs.”

In the lab

Hmadeh’s laboratory experiments have compared the performance of bismuth alloys to cement plugs. In one study, he conducted a leak test in steel pipes, comparable to an oil well, with a 185 mm cement plug and a 121 mm bismuth- tin alloy plug.

When Hmadeh conducted hydraulic “push-out” tests and leakage tests with nitrogen gas, he found that bismuth alloy plugs had higher resistance to applied pressure and reduced gas migration compared to cement, which meant the bismuth alloy makes a better seal.

But Hmadeh cautions that it’s a long way from the lab bench to actual wellbores, so much more work is needed.

“Our team at NTNU is doing a great job making extensive knowledge about this new technology public and accessible for everyone,” he said. “It’s too early to draw conclusions. But this plug has great potential. We have to upscale it to see how it will behave at different lengths,” which will take some years.

What is SWIPA?

SFI SWIPA stands for Subsurface Well Integrity Plugging and Abandonment. It is a centre for research-based innovation (SFI) established under the auspices of the Research Council of Norway from 2020-2028.

SFI SWIPA aims to obtain a scientific understanding of permanent well barriers to allow for improved well barrier design methodologies. The centre’s director is Harald Linga of SINTEF. In addition to SINTEF, the centre’s research partners are NTNU, NORCE, IFE, and University of Stavanger, while its financial industry partner are Aker BP, Equinor and Wintershall Dea.

Its primary goals are to:

- Facilitate rapid deployment of well barrier establishment and plugging and abandonment (P&A) technologies and system solutions that reduce offshore P&A costs by 50%.

- Increase value creation in the Norwegian oil and gas industry by the implementation of new P&A- and sidetrack solutions.

- Create new solutions and products for well integrity issues for CO2 storage, nuclear waste storage and reconversion of petroleum wells.