Russia shot down one of its own drones — a large and stealthy S-70 — after it flew uncontrolled into Ukrainian territory in early October, sparking speculation about how Moscow lost control of this valuable asset so publicly. It’s an unforced error that will be keenly felt in Moscow, whose high ambitions for producing its own drones have been slow to take flight.

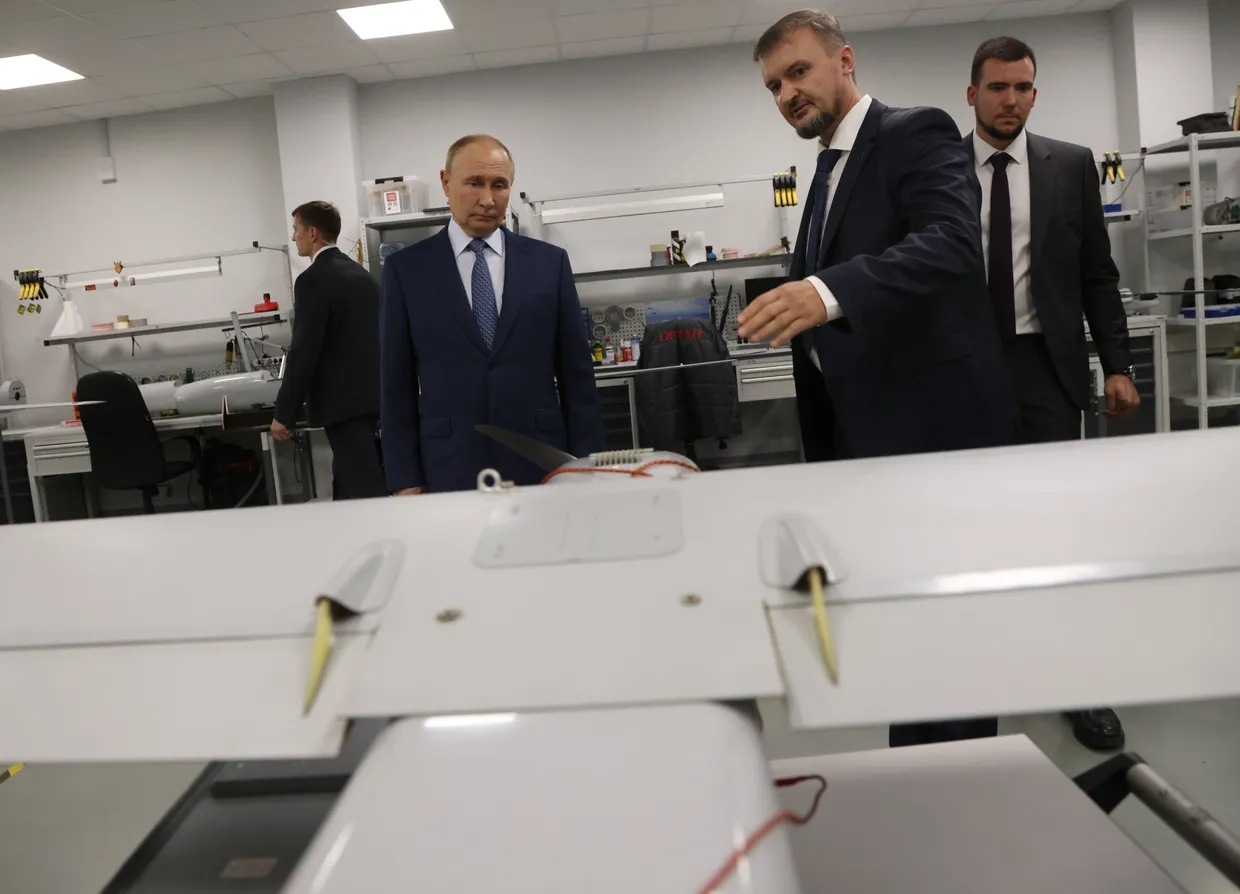

Given shortfalls in manpower, munitions, artillery, and aircraft, Russia has signaled its belief that uncrewed systems could be transformative in an attritional war, listing drone production among the Kremlin’s priority projects. Russian President Vladimir Putin has also announced plans to increase drone production tenfold in 2024, aiming to manufacture 1.4 million this year.

But is this realistic or just more propaganda?

Russia will struggle to meet this target and will likely have to rely on China to procure enough drones. To supply this demand, China would need to significantly boost its own production.

After its invasion of Georgia in 2008, Russia ramped up investment in unmanned aerial vehicles. Yet drone production was not prioritized, and Russian firms fell short of international competitors like China, the U.S., Israel, and Turkey.

The large combat models like the S-70 and smaller, more disposable reconnaissance drones that have been produced suffer from low manufacturing output, reflecting difficulties in moving from prototype to serial production — a problem that plagues the Russian defense industry in general.

Since the full-scale invasion, Russia has deployed low-cost Chinese quadcopters in vast numbers, while another Russian company, Albatross, has localized production of Iran’s Shahed, a loitering munition or “kamikaze” drone. That Russia has leaned so heavily on Chinese and Iranian support highlights the difficulties the Kremlin has faced in meeting surging battlefield demand for new drones due to bottlenecks in domestic production.

Despite a glut of new state funding for the military, Russia’s defense industry remains hampered by systemic issues, such as poor productivity, low profitability, corruption, aging infrastructure, a shortage of workforce skills, and continued reliance on foreign parts and machine tools amid Western sanctions. Scaling up production and supply chains is not straightforward.

Russia’s defense industry has repeatedly adapted more quickly and effectively than outsiders expect, leveraging the country’s vast reserves, high levels of state influence over strategic enterprises, and illicit networks.

To meet Putin’s ambitious goals, Russian defense managers will have to work along three lines: boosting manufacturing, accelerating the localization of foreign drone technology or paying others to build them, and importing as many drones as possible to fill the gap when domestic output falls short.

Increasing productivity is a Kremlin priority but a difficult task. Firms face a tight labor market and must reorient supply chains toward Asia. Many critical technologies and machine tools are now harder to procure. Companies can buy parts from China and other trading partners or tap into a growing “gray trade” of components acquired through third countries. But this introduces quality control issues, especially since illicit supply chains often yield shoddy or counterfeit parts. These barriers make it clear Russia will not achieve its targets using domestic resources alone.

Albatross provides a case study of localizing production, as it produces a version of the Shahed at the Alabuga site in Tatarstan with funding from VTB. This illustrates how drone production could be a lucrative opportunity for new companies in the market. In Russia, entrepreneurship is often encouraged during periods of state need, and partnerships with foreign suppliers offer a quick way to take proven designs and sell a locally produced version.

Most importantly, to meet its targets, Russia will need to buy a lot of drones.

Given Russia’s growing dependence on China for parts and components, it seems unlikely the country will have the capacity to produce 1.4 million units domestically in the near future. Instead, Russia may become China’s largest drone customer.

According to RAND research, global production of drones was estimated at 2.4 million units in 2023, with China holding a 70% share (around 1.68 million units), and its company DJI plays a dominant role.

Recent reports indicate that another Chinese company in Shenzhen is producing drones to order for Kupol, a major Russian defense firm. However, China would need to significantly increase production to meet existing demand from elsewhere, further pushing the Kremlin into strategic dependency on Beijing.

Putin’s formal announcement of a “drone campaign” is significant, but bold new political targets won’t sweep aside complex industrial realities. The Kremlin will hope this unlocks financial resources and pressures defense managers to mobilize resources however they can. Still, it’s unclear how Russia can achieve such a sharp increase in drone numbers without relying on continued off-the-shelf purchasing, especially from China.

This campaign should serve as a signal to Kyiv and its partners that further investment in drone countermeasures is a priority, just as EU and NATO nations must continue to scale up their own drone production in support of Ukraine’s defense.

– James Black is assistant director of the Defence and Security research group at RAND Europe. John Kennedy is a research leader at RAND Europe. Rebecca Lucas is a senior analyst at RAND Europe. Published courtesy of RAND.